Alternative Fuels Americas, Inc. | |

|---|---|

| Symbol: | AFAI |

| Exchange: | OTCQB, PINK |

| 12 month range: | $.05 - $1.01 |

| 6 month range: | $ .05 - $ .45 |

| Shares outstanding: | 68 mm |

| Management & 10% Holders: | 46 mm |

| Reporting Status: | SEC Current |

*data current as of 6/30/13

The international biofuels and clean technologies sector is immense, and offers one of the single most profitable opportunities for investors to make leveraged returns in recent times:

•According to business intelligence provider, IntertechPira, the total value of clean technologies globally is expected to rise by over 250% to $525 billion in 2019. This represents average annual growth of 13.5% for the ten-year period from 2009.

•Bloomberg's Global Renewable Energy Market Outlook shows 2012 annual investment in clean energy assets at approximately US $189B, with an increase to over US $630B annually by 2030 (that’s a cumulative $7.6 trillion of new dollars of finance for the period between 2013-2030).

•By 2019 the global biofuels market is expected to more than triple from estimated 2009 bases of 15 billion gallons of ethanol and 3 billion gallons of biodiesel production to over 50 billion gallons in total.

A key for strategy for investing in this sector is to identify a company that has technology that is past the conceptualization stage and ready to work towards revenues in the near term so that they can be leveraged against future technology developments.

When people hear the term “Biofuels”, they picture economically impractical technology and products such as government subsidized aviation fuel being produced at prices near $60.00 per gallon with no chance of any near term profitability. However, Alternative Fuels Americas, Inc. (OTCQB:AFAI) is very different because they have self-invested to create a pathway to profits which could allow them to quickly grow into a world-class biofuels concern.

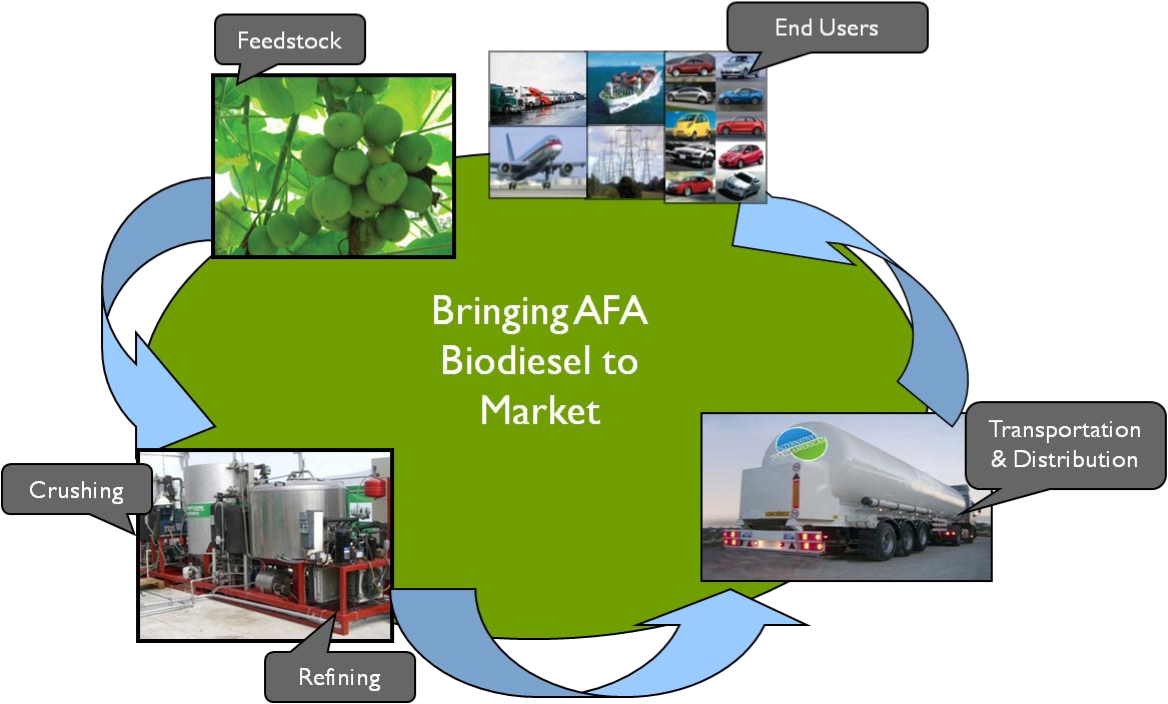

AFAI is an advanced stage multi-feedstock seed-to-pump green energy company establishing "above ground" oil fields and exploring broader biofuels opportunities throughout the Americas since 2005. AFAI is focused on producing jet fuel, marine fuel, fuel for trucking and commercial transportation, fuel to power industrial processes, and fuel to enable human mobility.

AFAI has engaged in plant trials, research and development and biofuels strategy development as they move to open their first biodiesel refinery in Costa Rica. Today AFAI has more than 40,000 Jatropha trees planted and a comprehensive growth plan in place. With these, they are among the few companies with both the vision and the knowledge for execution. The raw material (feedstock) is grown on their own farms and will be processed into biofuel in company owned oil refineries to provide profitable, sustainable energy.

By utilizing advanced oil refining technology, a proprietary business model and certain geographic/geopolitical considerations AFAI has solved the biofuels puzzle for sustainability and is preparing to deliver biodiesel at an amazing low price point of $1.89 per gallon** to enter the global biofuels market.

They are targeting initial biodiesel production for Fall 2013, and have already pre-sold the first 3.7 million gallons (approximately $14 million in revenues) to ramp up for larger operations as part of their global business plan.

AFAI’S SEED-TO- PUMP PRODUCTION CHAIN FROM ABOVE GROUND OIL FIELDS

Once AFAI delivers revenues from the sale of biodiesel they intend to leverage these gains to enter the green jet fuel market with the same focus on near term revenues and profitability, as well as evaluate other opportunities within the larger alternative energy marketplace (whether through joint venture or outright acquisition).

AFAI has a highly cost-efficient business model- The Company can produce a barrel of refined biodiesel for $79.50 ($1.89 per gallon seed to pump), a price point that permits substantial profitability.

The Company has Signed Off-Take Agreements for More than 3.7 Million Gallons – AFAI has signed, to date, four off-take agreements for the sale of 3.7 million gallons of diesel. These agreements pre-sell the Company’s entire production into the third year, and represent total revenues of approximately $14 million.

AFAI Operates in Markets Driven by Government Blending Mandates – The government of Costa Rica has passed a law that requires the blending of biodiesel with petro-diesel. The law mandate results in demand for 15 million gallons annually by 2013, increasing to 60 million gallons annually by 2020.

The AFAI Production Model is Scalable – The Company has identified equipment that is skid-mounted, transportable, modular and scalable. This allows AFAI to build its production capacity in conjunction with its feedstock supply – avoiding the need to construct costly facilities with excess capacity and limiting initial capital expenditures.

The Company has Proven Projectable Scale Based on Third Party Evaluation - There are more than 200 commercial Jatropha projects worldwide and the cumulative experiences, along with AFAI’s own extensive research & development, serve to validate the primary concepts of the Company’s feedstock model.

The Company has a Predictable, Secure and Stable Feedstock Supply – AFAI has signed 150 contracts with private landowners for access to wild feedstock. The Company estimates that these agreements represent approximately 500,000 gallons of biodiesel. Additional contracts are available for feedstock up to 2 million gallons. Moreover, AFAI is planting its own fields – 12,000 acres of Jatropha – to ensure a predictable and stable feedstock supply.

The Company has a Highly Regarded Value Proposition - AFAI is set to deliver high quality biodiesel at a market-accepted cost. The Company furthers its proposition by pursuing and executing a program that provides for jobs in some of the poor rural areas of Latin America, while simultaneously reducing host country dependency on foreign oil. These combined contributions render the Company’s value proposition extremely worthy.

AFAI Initially Plans to Produce Biodiesel, Not Ethanol - There is significant controversy surrounding the production of ethanol, particularly when it has as its primary feedstock food sources such as corn. In the United States, for example, ethanol production, while initially hailed and supported, has since suffered setbacks as has been as causing the rise of corn prices and its production was stymied by high feedstock costs. AFAI has elected to initially focus on biodiesel because it can be produced from non-edible feedstock (such as Jatropha) and can be used in standard diesel engines without the need for any conversions or blending (drop-in fuel).

The Company could be a Leader in a $500Billion+ Market Sector – The biofuels sector is expected to generate more than 500 billion dollars annually by 2019. One of the key concentrations for biofuel production will certainly be Latin America, as the region has the climate, available affordable land, inexpensive workforce and existing agricultural infrastructure to become a global production center. AFAI is well positioned to become a leader in the Latin American biofuels industry, thereby making it a global leader.

Craig R. Frank – Chairman and Chief Executive Officer - Craig has been the Company's Chief Executive Officer and driving force since its formation in 2005. He has been the primary architect in the development and implementation of the company’s vision, strategies and business plan and has developed the company from a concept to its current stage. Prior to founding AFAI, Craig was the founder and CEO for 11 years of The Tudog Group, a Florida based business advisory firm where he worked with more than 200 companies from 19 countries, including all of Central America.

Dr. Sam Stern - Chief Operating Officer - Sam brings to AFAI a wealth of experience in both technical and management fields. Sam served as General Manager for one of Continental Grain Company’s agribusinesses in Latin America (Ecuador), a position he held for over 17 years. More recently, Sam was the General Director of the Centro Nacional de Acuicultura e Investigaciones Marinas –CENAIM (National Aquaculture and Marine Research Center) in Ecuador. His strong operational experience combined with his technical know-how and his 24 years of residing in South America, make him a welcomed addition to the AFAI management team.

Dr. Helga Rodriguez – Chief Science Officer – Helga is a biologist with broad experience in biotechnology acquired over 20 years of work with national and international organizations in the Americas. Among other assignments, Helga has held various research and management positions with; the National Federation of Coffee Growers in Colombia; the Plant Biology Unit of the Pontificia Universidad Javeriana in Bogata, Colombia; the Plant Molecular Biology and Virology Laboratory in Costa Rica; Argibiotecnologia de Costa Rica; Guayaquil University in Ecuador; University of Gent in Belgium; and Instituto Nacional de Innovacion y Transferencia en Technologia MAG, in Costa Rica. Helga earned her PhD. in Forestry and Environmental Studies at Yale University in 2001.

Carlos Blair – Chief Agronomist – Carlos is a leading expert on the agronomy of the Jatropha plant and has been engaged in the successful piloting of Jatropha plantations since 2009. He is an instructor at the National Institute of Instruction and serves as General Director of Agronegocios Costa Rica Para el Mundo S.A.

Carrie Schwarz - Carrie is the Managing Partner of Athena Assets Management, a New York based hedge fund. Prior to her forming Athena, Carrie served on the Arbitrage team at Bank of America. Carrie has also served as a trader for Metropolitan Capital, a New York based hedge fund with more than $500 million under management.

Jordi Arimany - Jordi is a seasoned investment banker and businessman, with experience in both the US and Central America. He has served at both Miami based Latin American Financial Services (Lafise) and Central America’s largest bank, Banco Industrial.

a. insider buying, capital funding.

A read of the 2012 10K shows that management and consultants converted approximately $700K of capital contributions, accrued expenses and salaries into restricted stock at approximately $.24 per share. Additionally, management and certain consultants agreed effective January 1, 2013 to take no compensation during the first Quarter of 2013 so that funds could be earmarked towards maintenance and growth of assets in Costa Rica so that oil production can commence as quickly as possible.

Since December 31, 2012 new funding has come into the company as short-term loans from management, founding shareholders and new investors. Additionally, the company intends to use special purpose vehicles/entities to generate capital to launch their Costa Rican Operations.

(This information is based on data in the referenced AFAI 10K for the 2012 FYE filed 04-24-2013. For more information please consult subsequent filings when available or ask a company officer.)

b. Monthly trading activity

| Month | open | high | low | close | change | volume |

|---|---|---|---|---|---|---|

| 09/25/13 | 0.15 | 0.15 | 0.05 | --- | --- | 24,561 |

| 08/20/13 | 0.12 | 0.15 | 0.08 | 0.15 | +0.03 | 236,641 |

| 07/31/13 | 0.12 | 0.13 | 0.10 | 0.12 | +0.00 | 95,640 |

| 06/28/13 | 0.16 | 0.16 | 0.12 | 0.12 | -0.03 | 400 |

| 05/31/13 | 0.28 | 0.28 | 0.10 | 0.15 | -0.13 | 341,942 |

| 04/30/13 | 0.45 | 0.45 | 0.10 | 0.28 | -0.17 | 739,144 |

| 03/28/13 | 0.45 | 0.45 | 0.45 | 0.45 | +0.00 | 0 |

| 02/28/13 | 0.45 | 0.45 | 0.45 | 0.45 | +0.00 | 0 |

| 01/31/13 | 0.45 | 0.45 | 0.45 | 0.45 | +0.00 | 0 |

| 12/31/12 | 0.45 | 0.45 | 0.45 | 0.45 | +0.00 | 0 |

05-22-2013 AFAI Successfully Concludes Biodiesel Research Trials, Moves Towards Production

04-24-2013 AFAI files 10-K Annual Report

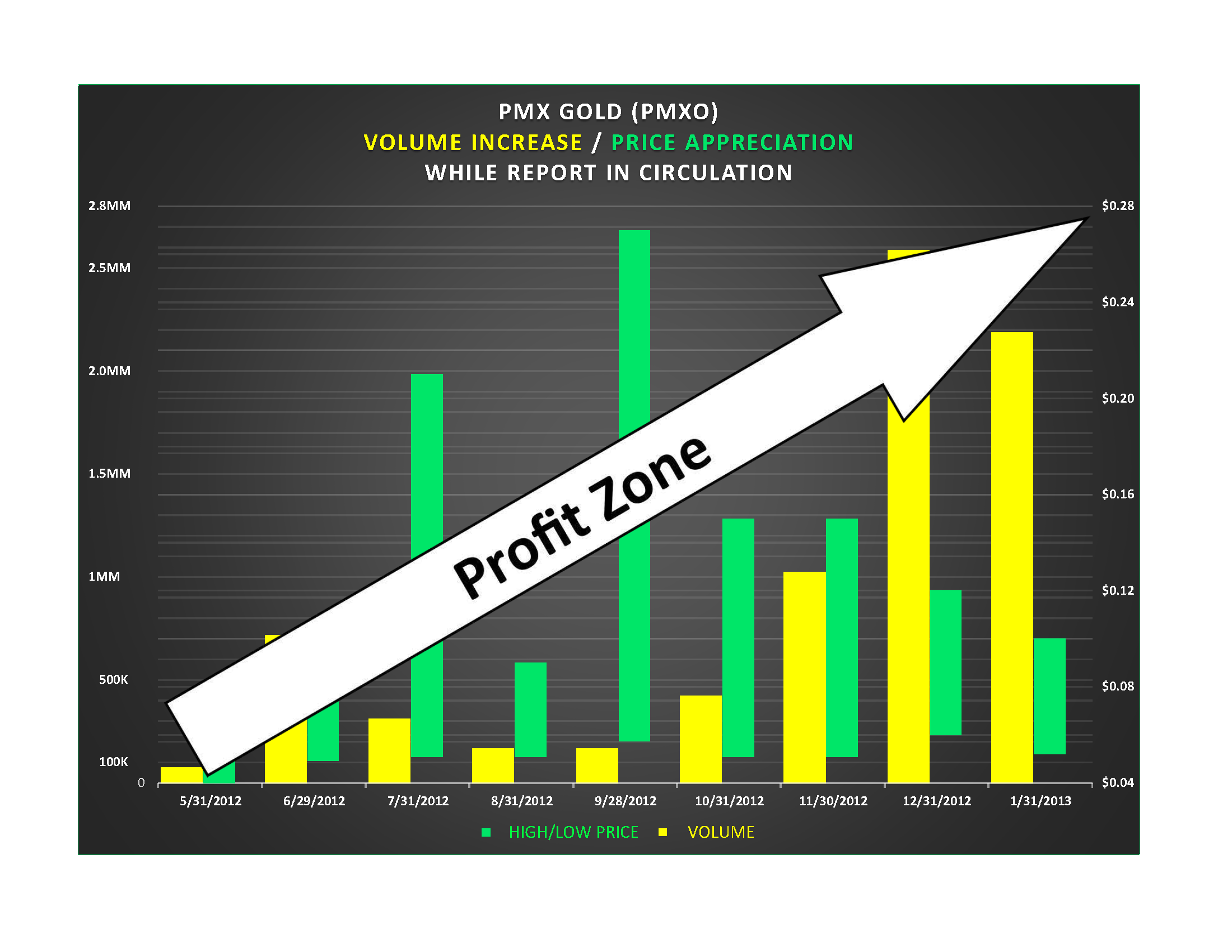

Take a look at the trading history of the last company we profiled to our network from mid 2012 to January 2013, culminating with the publication of the November 2012 issue of “WALL STREET PROFIT SEARCH, SPOTLIGHT ON GOLD BULLION VENDING”

| month | open | high | low | close | change | volume |

|---|---|---|---|---|---|---|

| 1/31/13 | 0.0711 | 0.1000 | 0.0521 | 0.0669 | -0.0020 | 2,188,712 |

| 12/31/12 | 0.1200 | 0.1200 | 0.0600 | 0.0689 | -0.0011 | 2,587,331 |

| 11/30/12 | 0.0900 | 0.1500 | 0.0510 | 0.0700 | -0.0200 | 1,042,791 |

| 10/31/12 | 0.1500 | 0.1500 | 0.0510 | 0.0900 | -0.1100 | 422,594 |

| 09/28/12 | 0.0700 | 0.2700 | 0.0575 | 0.2000 | +0.1300 | 168,994 |

| 08/31/12 | 0.0900 | 0.0900 | 0.0510 | 0.0700 | -0.0200 | 168,650 |

| 07/31/12 | 0.0750 | 0.2100 | 0.0510 | 0.0900 | +0.0150 | 312,757 |

| 06/29/12 | 0.0600 | 0.0750 | 0.0493 | 0.0750 | +0.0150 | 717,076 |

| 05/31/12 | 0.0600 | 0.0600 | 0.0400 | 0.0600 | +0.0000 | 75,311 |

Note that during this time volume increased from less than 100K shares in May to a high of over 2.5 million shares for December, and the price ranged from a low of $.04 to $.15 to a technical peak of $.27, with over 6 million shares trading between October and January when the report was in circulation!

AFAI is now ready to "go public with their story" which includes details such as founders putting their life savings in the company, insiders acquiring restricted stock @ $.24 per share in exchange for debt from accumulated expenses and paid-in capital, and management waiving salaries during the first part of 2013 so that all available funds can be earmarked to start green oil production.

Wall Street Profit Search has been retained by a third party non-affiliate to raise market awareness of AFAI to coincide with pending developments and milestones. We intend to initially publish up to 100,000 hard copies of our newsletter featuring this amazing company to overlap with major media and Wall Street exposure through several different outlets.

Past performance is not necessarily indicative of future results, but we believe that AFAI is a very strong situation and an incredible story, and that the company is ready to break through and shine in the biofuels industry.

Stay tuned to www.wallstreetprofitsearch.comand make sure to register for your copy of our upcoming newsletter and follow-up in-depth report on AFAI.

For more information call us at 561-210-7664 or email wallstreetprofitsearch1@gmail.com

Important Disclosure: As is noted elsewhere on our website, we are compensated for the profiling and advertising of stocks that we feature. Please refer to the Important Disclosure section of our website to review the specific compensation we have received involving AFAI as well as other important considerations that you should consider.